Current

informs.

All news at a glance.

We keep you up to date

We bring you the latest developments and news directly to your screen!

Current dates and developments always in view.

Property tax reform: overview of models and required data

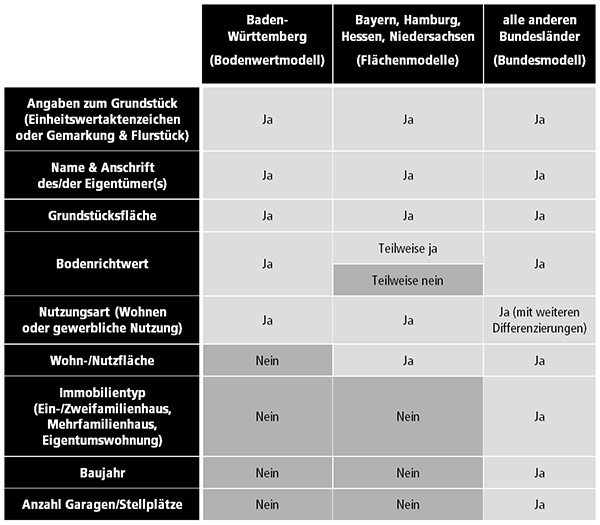

The various property tax models of the individual federal states differ significantly in the scope of the data required for the assessment declaration.

In the following table you will find a comparison of the different models including the data required for the declaration of assessment in the respective federal state. For some of the necessary data, you will also find notes on where to find this information.

-

Property data: You will find the standard value file number for your property, for example, in the annual property tax assessment notice from the municipality or in the basic assessment notices from the tax office that you received after purchasing the property. Alternatively, or in some cases additionally, it is necessary to indicate the district and the parcel. For condominiums and part-ownership, the co-ownership share attributable to the condominium or part-ownership is also important. You can find the district, parcel and, if applicable, co-ownership shares in the land register excerpt or in the purchase contract, and the co-ownership share, if necessary, can often be found in the property management company's statement of charges.

-

Area: The land area can be found in the purchase contract or in the extract from the land register. For buildings, except in Baden-Württemberg, the living or usable area must also be stated, but this is not always shown in the purchase contract. For this purpose, a living/usable space calculation is required, which has been prepared by the architect or which may have to be newly prepared in the case of old buildings or conversions.

-

Ground value: Some federal states do not specify the standard land value because it is determined automatically by the tax office or does not play a role in the calculation (Bavaria, Hamburg). You can get a preliminary impression of the standard land value in the Ground Reference Value Information System BORIS provide. However, the individual federal states are setting up separate portals for the declarations of assessment, because in some cases different values have to be entered here. The federal states will provide the address of the respective portal in their information letters to citizens or publish it on the BORIS site as of July 1, 2022.